Managing your financial future doesn’t have to be daunting…

Many successful families feel like planning for their financial future is too complex and intimidating. Some even believe that building a roadmap designed to accommodate their vision is unattainable. At RS Asset Management we believe that our clients can and should experience optimal wealth planning and finance management previously reserved only for the ultra wealthy. At RS Asset Management, we are committed to bringing precision wealth management to a new set of investors.

There’s a lot at stake.

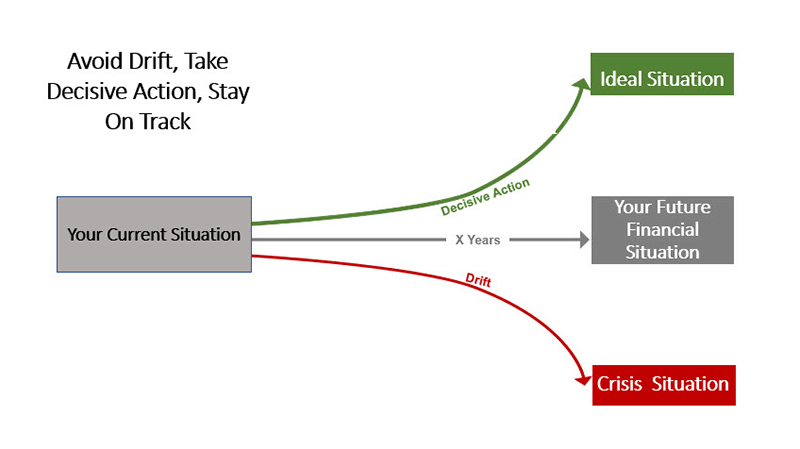

What path are you on?

Financial planning can be tedious and complex. You’ve worked hard to get here, you deserve more.

Life is too short to worry about your future outcomes. We have created hundreds of robust financial road maps to help high-net-worth clients preserve what they have, stay on track, and support their future.

Accelerate your outcomes.

By taking decisive action – framing and quantifying your vision – you have the potential to “jump the line” to financial freedom.

Our planning helps you confidently act, save time, avoid financial drift, and pursue your optimal financial outcomes.

Getting started is simple…

By framing and quantifying your vision for you and your family’s future and then creating your strategy, we can help you pursue your goals and stay on track with confidence. Whether you are targeting a fruitful retirement or a smooth transition to the next chapter in your life, our 3-step process will help get you working towards your financial freedom.